Living Or Working Overseas and the State Pension

So, you’ve spent your youth working in UK & then built a life on the sunny beaches of Australia?

You’ve put in the hard work during your years in the UK, paid your National Insurance, and now you don’t know: “What happens to my State Pension?” Does moving abroad has make it inaccessible for you? Or is there still a way to get it?

Most of the overseas workers assume that leaving the UK has left their pension behind. But the truth is quite opposite. You didn’t lose a single penny. But there are steps to follow, & rules to be aware of, especially for Australia.

We know them all. Because we’ve helped thousands of people like you claim their British pension in Australia. Including full entitlements, back pay & secure monthly payments. So, let’s prepare you too & make sure your years of hard work doesn’t go to waste.

What is State Pension for Overseas Workers?

The UK State Pension is a financial benefit provided to the ones who have contributed to the UK’s National Insurance (NI) system during their working life. It offers support in retirement, based on how many years you’ve paid into the system.

If you’ve decided to live or work abroad for your remaining life. You’re still entitled to this pension, as long as you meet the qualifying conditions. However, living overseas changes what amount you can get & how you’ll receive it.

The rules are different depending on the country you move to. Some places offer full annual increases, while others do not. Australia falls into the latter category.

Overseas And the State Pension: Why There Should be Transfer Channels?

Leaving the UK doesn’t mean leaving your pension behind. There is a huge number of people who’ve contributed in UK NI and now are living overseas. If we look at the numbers:

“There are 12.9 million UK pensioners worldwide, of which about 1.1 million (9%) live overseas.”

Means a huge number of expats will lose their money if there is not a proper system of transferring the pensions. This calls for the need of assistance channels like British Pensions. Because the entitlement is based on what you paid into the NI system, not where you live.

So, whether you’re in Sydney or Singapore, you deserve to get what you earned.

Types of UK Pensions & Which One Is for You

There are two main types of UK State Pensions based on the age of workers.

1. Basic:

Basic or old pension applies to people who reached pension age before 6 April 2016. You’ll need at least 30 qualifying years of NI contributions or credits. The full pension amount is fixed, and the additional entitlements apply based on employment history.

2. New:

Then on 6 April 2016, an updated version of UK state pension is introduced. For that, you’ll need a minimum 10 years of NI contributions & 35 qualifying years. You can adjust the criteria via additional pension through workplace schemes.

You can get new pension if:

- You are a female & born on or after 6- April 1953

- You are a male & born on or after 6- April 1951

Those who are getting basic state pension before 6 April 2016 will continue to receive it. But the claimants after this date will receive the new. It is to rule out the old version eventually.

What is the UK Pension Age?

The UK State Pension age is the earliest age you can begin claiming your pension. If you’re living overseas and nearing retirement age, it’s essential to check the exact date when you become eligible, as this affects when you can start receiving payments.

You can calculate your pension age at UK Govt Calculator.

Right now, UK state pension age is set at 66 years for both men and women. However, that’s not fixed for the future. The UK Government is gradually increasing the pension age:

- To 67 by 2028.

- And potentially to 68 in the following decade (not confirmed & subjected to changes).

Let’s go into details.

Changes from April 2026

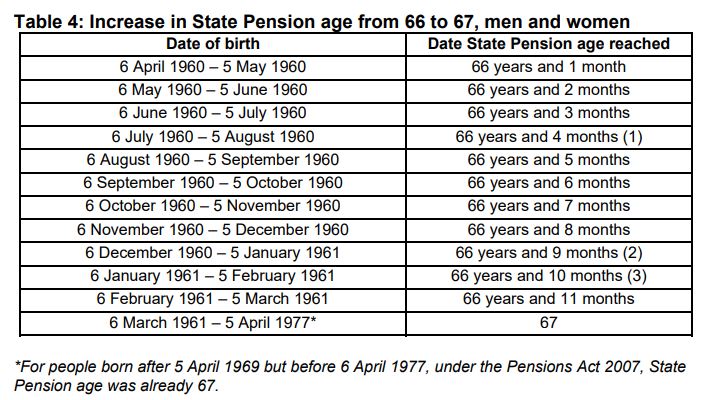

The Pensions Act 2014 decided increase the pension age from 66 to 67 on April 2026. But the interesting thing is, it will not increase in a single transition. Instead, it will rise gradually on every month between 2026 and 2028.

The following table shared by UK govt summarises these phased changes.

This shift will affect when you become eligible to start drawing your pension and the amount of back pay you might receive if you delay your claim.

Are You Eligible for UK State Pension?

Other than the age factor, you must meet the following criteria to qualify for UK pension Australia.

- At least 10 qualifying years of National Insurance contributions or credits (don’t have to be consecutive).

- Long-term, short-term or part-time work in the UK.

For details, read: UK State Pension in Australia: Eligibility, Amount & New Rules

If you’re not sure about your NI record, review it with the help of experts like British Pensions. Because there are several ways to make voluntary NI contributions to cover gaps. We assess and advise on it during our initial 15-minute consultation.

British Pension in Australia: What Are the Rules?

If you live in Australia, you are entitled to receive your UK pension. But there are several regulations you have to follow and certain complexities you should keep in mind.

Important rules to remember are:

- You can receive full pension payments, directly into your Australian bank account.

- The taxation and exchange rates will apply.

- No automatic cost-of-living increases will apply unless the UK makes changes to its international pension policy (Frozen pension).

What is a Frozen Pension?

It means your UK pension will not increase annually, if you are claiming it from Australia. As the government doesn’t apply annual uprating if you transfer the UK pension to Australia. Unlike in the UK, EEA regions or countries with reciprocal social security agreements.

Hence,

- Your pension value stays at the level when it first began.

- Over time, inflation reduces its real-world value.

- You’ll lose thousands of pounds in potential increases.

But don’t worry. There are several strategies for maximizing benefits through accurate claims and backdated payments. Understanding this will help you decide when and how to claim to get the maximum benefits.

Process of Claiming UK State Pension

Even if you’re eligible for British aged pension, the government won’t pay it unless you claim it though proper channels.

Here’s the guide to claim your UK pension in Australia:

| Step | Description |

| Eligibility Check | You can check for yourself or book a call with us to assess your UK pensions Australia entitlement. |

| Age Requirement | You have to calculate your pension age and make sure 4 months have passed after that. |

| Document Collection | You’ll need items like proof of identity, NI number, birth certificate, and sometimes marriage certificates. |

| Form Completion | Special forms are required for overseas claimants, often complex and time-sensitive. |

| Submission to UK Authorities | The application is needed to be submitted to relevant authorities in UK. |

| Follow-up and Communication | After submission, you have to keep an eye for further updates and maintain a communication link with authorities. |

Details at: How to Transfer UK Pension to Australia? A Definitive Guide

If you don’t claim on the moment, you can also defer it and receive higher payments in the future instead. We offer to simplify he procedure and help you decide the best options. That’s why our clients never deal with forms, hold times, or errors.

When & How Will You Get Paid?

Once your claim is approved, you’ll get your UK state pension via:

- Bank account in UK

- Your personal Australian bank account

- Joint account

- Australian Bank account of someone else with their permission.

You can calculate your due amount via UK govt website or call an expert from British Pensions. Some details to keep in mind are:

- Processing takes about 16 weeks, but delays can occur with incomplete documents.

- Payments are issued every 4 or 13 weeks, based on your preference.

- You’ll receive direct deposits into your selected bank account.

- If your pension is under 5 Pound/week, you’ll be paid annually in December.

You can avoid unnecessary delays by submitting a correct application the first time.

How Much Will You Get? Exchange Rate & Taxation

Well, there are a lot of factors involved in deciding your amount of pension. E.g.

- How many qualifying years you’ve worked.

- Which pension type (Basic or New) applies.

- You’ve applied for any additional workplace schemes or not.

- Exchange rates: Your pension is paid in GBP, converted into AUD.

- Local tax obligations: UK pensions are not taxed there, but they can be taxed in Australia. The amount depends on your total income and residency status.

A tax adviser familiar with dual-country tax rules can help you calculate your potential payment.

Tips to Maximise Your Pension

If you’re an oversea worker who’ve formally contributed in UK, we advise you to:

- Claim early: Delays can reduce your lump-sum entitlement.

- Review your NI record: Fill any gaps with voluntary payments.

- Keep documents handy: Like passports, NI numbers, and certificates.

- Consult experts: Avoid mistakes and missed payments.

Read more at: Guide to Maximising Your UK State Pension in Australia (2025)

Because living abroad shouldn’t mean leaving money behind.

Need Help Claiming What You’ve Earned?

Get Expert State Pension Advice from British Pensions

We’re helping expats & former UK workers claim their British state pension for 30 years. Over 4,000 claims are succeeded with our help since 1990. From eligibility checks to document gathering and claim submission, we handle it all.