How to Transfer UK Pension to Australia? A Definitive Guide

“Can I transfer my UK pension to Australia?” is a question we hear all the time at British Pensions, and the answer is: Yes, most likely, but there’s a bit to know to do it right.

Thousands of retirees, expats, and even Aussies who’ve worked across the pond are eligible to claim UK pension from Australia. But moving that hard-earned British pension in Australia can feel like navigating a pile of confusing paperwork and regulations.

Don’t worry. We’re here to break it down for you in an easy, step-by-step guide.

At British Pensions, we’ve helped over 4,000 people since 1990 with their UK pension transfer to Australia. We’re excited to share our expertise to make your pension claim process smooth and stress-free.

Whether you’re chasing UK pension back pay, monthly payments, or a lump sum, this guide will walk you through everything you need to know about overseas pension transfer and how to secure your pension entitlements in Australia.

Let’s get started.

Can You Transfer Your UK Pension to Australia?

Yes, you can, but it depends on your specific pension plan.

If you have a UK private or workplace pension, there’s a good chance you can transfer it to Australia. But before you make the move, you’ll need to make sure your pension qualifies for transfer under certain rules.

To start, your UK pension must be moved to a QROPS (Qualifying Recognised Overseas Pension Scheme) that’s approved by HMRC. This is an essential step. QROPS schemes meet UK government standards and can help you avoid unnecessary tax charges when moving your pension abroad.

So, What Exactly Is a QROPS?

A QROPS (also called ROPS) is a type of overseas pension plan that meets the UK’s conditions for pension transfers. These schemes were created to help UK pension holders safely and legally move their pensions to another country.

If your Aussie super fund is a QROPS, here’s what you can expect:

- Combine different UK pensions into one simple account

- Avoid UK taxes on your pension income

- Get potentially better tax treatment in Australia

- Receive payments straight to your Australian bank account

- Shield your pension from UK inheritance tax

Remember that moving your pension overseas could come with tax consequences. These can get a little complicated and may vary depending on your individual situation and where you’re moving. That’s why it’s wise to talk to a financial adviser who specialises in pensions or international tax to make sure you’re making the best decision.

Now, let’s move towards the basic factors you need to know before getting into the transfer procedure.

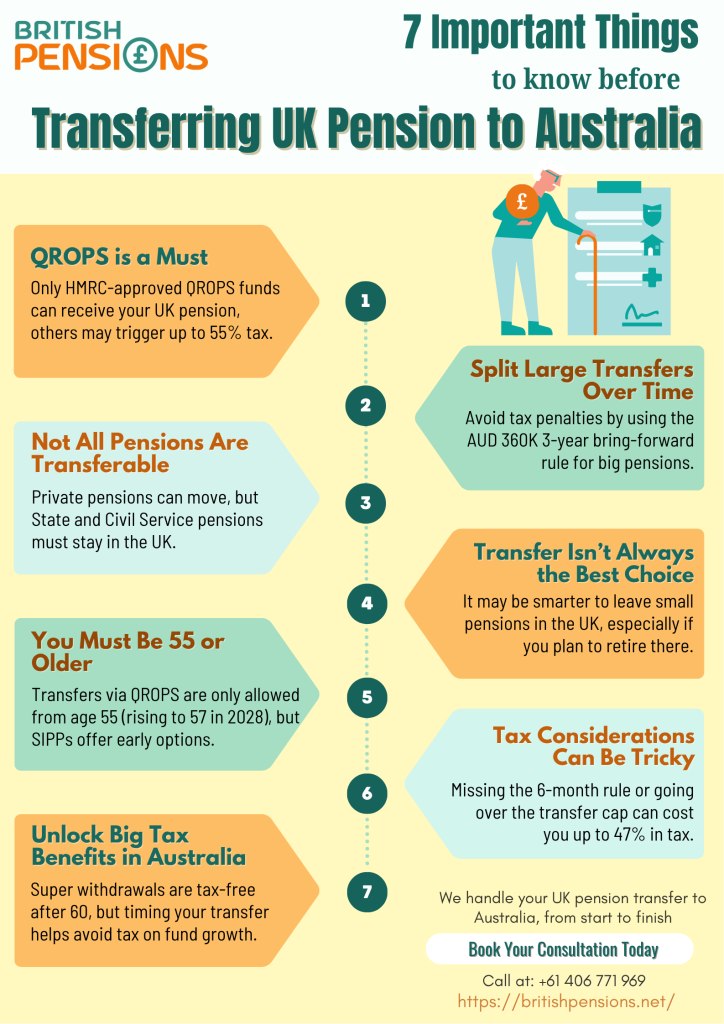

7 Important Things to Know Before Transferring Your UK Pension

Transferring your UK pension to Australia is a big step. Getting it right can make a huge difference to your retirement planning. Take note of the following points to avoid costly mistakes and make the most of your pension entitlements.

1. QROPS Matters: Your Ticket to a Smooth Pension Transfer

Before anything else, your Australian super fund must be a QROPS (Qualifying Recognised Overseas Pension Scheme) approved by HMRC. Without QROPS approval, your transfer could get rejected or hit with a nasty tax penalty of up to 55%. Yep, you read that right.

At British Pension, we make sure your fund qualifies as a QROPS before any paperwork starts. Our team handles the transfer process from start to finish so you can focus on planning your retirement, not stressing over forms.

2. Not Every UK Pension Can Be Transferred

Wondering if all your UK pensions can move to an Australian super fund? Most private pensions, like occupational or personal schemes, can be transferred to a QROPS Australia (more on that later). But some pensions are locked in the UK.

Here’s the rundown on what’s transferable and what stays in the UK:

- Pensions You CAN Transfer:

- Occupational Pension Schemes: Workplace pensions from private employers.

- Defined Benefit Schemes: Final salary pensions (if the scheme allows overseas transfers).

- Defined Contribution Schemes: Personal pensions or stakeholder plans.

- Small Self-Administered Schemes (SSAS): Specialized pensions for small businesses.

- Pensions You CAN’T Transfer:

- UK State Pension: You can’t transfer it, but you can receive secure pension payments in Australia. Apply any time before or after reaching state pension age (66 in 2025) if you’ve paid enough National Insurance contributions. Contact the UK’s International Pension Centre. No strict deadlines apply.

- Unfunded Civil Service Pensions: Includes pensions for NHS workers, teachers, police, firefighters, and armed forces. These stay in the UK but may be payable overseas.

3. Age Matters for Transfers

You need to be at least 55 to transfer UK pension to super via QROPS Australia (this rises to 57 by 2028).

If you’re under 55, don’t worry. There’s a workaround. You can move your UK pension to a UK-based SIPP (self-invested personal pension) to consolidate your funds and invest in Australian assets. When you hit the right age, we’ll help you transfer the SIPP to a QROPS Australia.

Our team at UK Pensions explores all options during your free consultation, ensuring your pension entitlements are ready when you are.

4. Take Advantage of the Big Tax Benefits (But Be Careful!)

One of the best benefits of transferring your UK pension to Australia is the potential for serious tax savings.

In the UK, your pension contributions got tax relief (basic-rate at source, with extra relief for higher earners). In Australia, superannuation contributions are taxed, but withdrawals from your super fund are tax-free after age 60 (up to AUD 3 million). That’s a game-changer for your retirement planning.

But here’s the catch. The growth in your super fund is taxable until you start an income stream, especially if you transfer after 6 months of becoming an Australian resident. Our experts at British Pensions time your overseas pension transfer to dodge unnecessary taxes, ensuring you keep more of your pension entitlements.

5. You Might Need to Split Your Pension Transfer

Australia has a cap on non-concessional contributions, which is the money you’ve already paid UK tax on. For 2025, that cap is AUD 120,000 per year. However, thanks to the bring-forward rule, you can move up to AUD 360,000 over three years.

If your pension is worth more than that, you’ll need to split the transfer across multiple financial years to avoid a 47% tax on the excess.

For individuals up to age 75, the bring-forward rule still applies, but those between 67 and 75 must meet a work test (like working 40 hours in 30 consecutive days during the financial year).

Our team maps out a transfer plan that works within these limits. No surprise tax bills, no stress.

6. Transferring Isn’t Always the Best Move

Overseas pension transfer sounds great, but it’s not a one-size-fits-all solution. For some, the costs of transferring a small pension might outweigh the benefits. Or, if you’re planning to return to the UK for retirement, keeping your pension there could make more sense.

Transferring also means your pension won’t grow with UK inflation, unlike some UK-based schemes.

7. Taxes Considerations of Transferring UK Pension to Australia

Taxes can make UK pension transfers to Australia feel like a maze. But we’re here to guide you. If you’re a permanent Australian resident and transfer to a QROPS Australia, you typically won’t pay tax on the transfer itself. But watch out for these scenarios where taxes might apply:

- Exceeding the UK Overseas Transfer Allowance (OTA): Transfers over £1,073,100 (2025) face a 25% UK tax on the excess.

- Non-QROPS Transfers: These unauthorised transfers are rare. But they could trigger up to 55% UK tax penalty (40% unauthorised payment charge + 15% surcharge if applicable).

- Missing the 6-Month Window: Transfer after six months of Australian residency, and pension growth could be taxed at up to 47% in Australia.

What’s the 6-Month Rule?

It is an exemption condition in which you can avoid Australian tax from your pension amount. It applies to UK pension transfers to AUS within six months of getting Australian residency. If you make the transfer during this period, the growth of your pension while you’ve been an Australian resident is tax-free. After the six months, any growth in your pension is taxed at up to 47% standard rate.

Read more about > Maximising your UK state pension in Australia

Now moving towards the process of bringing UK pension to Australia.

How to Transfer Your UK Pension to Australia | 4 Easy Steps

Moving your UK pension to Australia let you unlock your pension entitlements for a worry-free retirement Down Under. Let’s get your British pension in Australia sorted in four simple steps:

Confirm Your Pension Eligibility

First things first. Not all UK pensions can hop across to Australia, so you need to check what’s transferable. Most private pensions, like occupational or defined contribution schemes, can move to a QROPS Australia (a super fund approved by the UK’s HMRC).

But some, like the UK state pension or NHS final salary schemes, can’t be transferred (though the state pension can be paid to your Aussie bank account).

You’ll also need to be at least 55 to transfer most private pensions (rising to 57 by 2028), but younger folks can explore options like a UK SIPP until eligible.

Worried about the details? Our free 15-minute consultation at British Pensions checks your UK pension eligibility and maps out your pension entitlements, so you know exactly what’s possible.

Choose a QROPS-Approved Super Fund

To transfer UK pension to super, your Australian super fund must be a QROPS Australia, listed on HMRC’s Recognised Overseas Pension Schemes (ROPS) notification list (HMRC ROPS list).

Good news: Australia has plenty of QROPS-approved funds, from big super providers to specialised schemes.

Picking the right fund is crucial. Non-QROPS transfers can trigger up to 55% UK tax penalties (also mentioned above). We take the guesswork out by verifying your super fund’s QROPS status and ensuring your international pension claims meet all requirements, saving you from costly mistakes.

Verify Your Pension’s Transfer Rules

Before you start the pension claim process, contact your UK pension provider to confirm they allow overseas transfers. Most providers permit transfers to a QROPS Australia, but some may have conditions, fees, or tax implications, like the UK Overseas Transfer Charge (25% if you’ve lived outside the UK for less than five years or transfer to a non-exempt scheme).

There’s no minimum pension value for transfers. So, even smaller pots can move (unlike some myths about a £20,000 threshold). British Pensions handles these checks for you, digging into your pension’s fine print to avoid surprises and maximise your secure pension payments.

Submit Your Transfer Application

Now it’s time to get the ball rolling. You’ll need to complete paperwork for your UK pension provider and Australian super fund, including details like:

- National Insurance number

- QROPS fund information

- Australian Tax File Number (TFN)

Unlike older processes, you don’t need a specific HMRC form like APSS 263, your provider handles most of the reporting.

What Are the Costs of Transferring Your UK Pension to Australia?

Transferring your UK pension to Australia isn’t free. But understanding the costs helps you make smart choices. Here’s what you might encounter:

UK Overseas Transfer Charge (OTC):

A 25% tax applies to some QROPS Australia transfers, but you’re exempt if you live in Australia and transfer to an Australian QROPS. To avoid the OTC, you must provide your pension provider with details like your residency status and QROPS information. One catch: if you move out of Australia within five years of the transfer, the OTC could kick in (e.g., a transfer in May 2025 stays exempt until April 2030).

UK Pension Provider Fees:

Your UK pension provider might charge a fee to process the transfer, while some Australian super funds add setup or ongoing management fees. These vary, so we check the fine print to keep costs transparent.

Adviser Fees:

Professional help like ours comes with a fee. But it’s worth it to navigate UK pension regulations and Australian super rules.

At British Pensions, our success-based fees mean you pay only when your pension entitlements are secured. No upfront costs. We follow strict rules to avoid conflicts of interest, ensuring you’re the only one paying us, not product providers.

Investment Costs:

If your super fund invests your pension, expect fees for the underlying strategy or ongoing advice. We ensure these costs are fair and aligned with the complexity of your pension claim process.

With British Pensions, you’ll see exactly what you’re paying and why, ensuring every dollar spent puts you in a better retirement planning position.

How Long Does a UK Pension Transfer Take?

Patience is part of the UK pension transfer to Australia, but we make it as quick as possible. On average, the pension claim process takes 16+ weeks from start to finish. Think about four months to get your secure pension payments or super fund sorted.

Why the wait? It depends on factors like:

- Your UK pension provider’s responsiveness (some are faster than others).

- The complexity of your pension (e.g., multiple schemes or large pots).

- Paperwork accuracy (incomplete forms can cause delays).

Need professional assistance for British pension transfers in Australia?

Start Your UK Pension Transfer with British Pensions Today

At British Pensions, we’ve been helping expats transfer their UK pensions to Australia for over 30 years. With us, transferring to an overseas pension is straightforward, secure, and rewarding. We make sure you get every penny you’re entitled to without added stress with a 95% accurate assessment rate and a success-based pricing model.

Don’t let red tape or distance stand in the way of your financial future.

Let us handle the paperwork and all the regulations. While you enjoy your retirement as well as your pension in Australia.